Restaurant Costs Breakdown: Spend Smarter To Stay Profitable

Your restaurant costs include labor, food, rent, online delivery and more—I’ll show you how to calculate and save on each in this guide.

Key takeaways

- Restaurant costs fit into both fixed and variable costs—understanding the two can help you plan and budget more efficiently.

- Labor and food costs are the two biggest costs to watch in your restaurant; knowing how to handle these expenses can mean healthy profits.

- Strategies like streamlining online orders, adjusting staff schedules, monitoring inventory, reviewing menu prices and switching to energy-efficient appliances can help you lower restaurant costs.

Out-of-control costs are one of the top reasons why restaurants fail. In fact, 82% of all small businesses fail due to cash flow issues. When costs spiral out of control, they can eat into your profits and compromise the quality of your food and service.

Let’s be honest—running a restaurant isn’t cheap. Between ingredients, paying your staff, keeping the lights on and covering rent, it feels like there’s always something eating away at your bottom line. I get it. But if you want to build a profitable and sustainable restaurant, keeping costs in check needs to be a core part of your restaurant business plan.

That’s why understanding and managing your expenses isn’t just important—it’s essential if you want to do more than just survive. You need to thrive, especially in such a competitive market.

Read more because I’ll explain costs in plain language and share the real pitfalls to look out for when handling your expenses.

Understand the types of restaurant costs

To manage our costs we first have to fully understand them. Let me break it down for you: costs usually fall into two categories: fixed and variable.

- Fixed costs are the ones that don’t change with volume or scale, like rent and utilities. You’ve got to pay them no matter how busy or slow business gets. For example, rent for your location stays the same if you sell 10 donuts or 100, but the cost for frosting changes as you sell more donuts.

- Variable costs change depending on how much business you’re doing. Things like food, labor and marketing will go up when your restaurant’s packed and slow down when things get quieter. Variable costs can also stay steady if your sales volume stays steady.

Understanding both your costs and expenses is crucial if you want to stay profitable. Restaurants are on slimmer profit margins than many other businesses, so managing costs is especially important.

By budgeting for those fixed costs, you’ll know exactly where your revenue is going and how much you can invest back into the business.

By planning for variable costs, you can avoid cash flow issues when things aren’t as busy. Variable costs, like prime costs, require the most planning, so you really need to understand how you’re spending money on food and labor—the two most important costs for the business.

Labor costs

Percentage of total cost: 28%-33%

Let’s talk about one of the biggest expenses you’ll face as a restaurant owner: labor costs. This includes:

- Wages and salaries

- Payroll taxes

- Paid time off

- Overtime

- Health insurance

- Benefits for employees

Your labor cost should be between 28% and 33% of your total revenue, but this is totally dependent on the type of restaurant you’re operating.

For example, a fine-dining restaurant may have a labor cost percentage closer to 30% since they likely have high-end menu items. These higher costs help justify the extra time and skill required to prepare them. Additionally, labor costs are influenced by state-specific minimum wage laws.

Labor costs are certainly a balancing act. You want to invest in great staff who stick around and ensure excellent service, but you also need to avoid "labor waste." Just like food waste, labor waste happens when you're paying employees who don't have enough guests to serve, which can eat into your profits.

Knowing your labor costs not only helps you manage your overall expenses but it can also reveal whether you're overstaffing during slow periods. I’ll show you how to calculate your labor cost percentage below:

How to find your labor cost percentage

Figuring out your labor cost percentage is pretty simple. Just use this formula:

Your labor costs are the total amount you’ve paid your employees or their wages in a year. Total revenue is what you’ve made that same year before any taxes and deductions.

So, if you’re spending $140,000 on labor in a year and bringing in $500,000 in revenue, your calculation would look like this:

This means you’re spending 28% of your revenue on labor. If you’re struggling to keep your percentage lower, read more to see my tips on how to cut back on labor expenses.

Tips to cut back on labor costs

If you find your labor cost percentage to be on the higher side, here’s what I recommend doing to get that number to a healthier place:

- Automate order management: Use an online ordering system that integrates with your POS. This helps reduce the need for extra staff to manage orders and minimizes errors. My friend Rahul of Saffron Indian Kitchen started to use Owner and told us that the majority of their orders come from the website and mobile app, so they no longer have to have two people on staff to answer the phones. He reassigned extra staff to cover other responsibilities.

- Try mobile marketing with an app: Let your customers place orders through a mobile app, so you don’t need extra staff for phone orders. Owner.com’s custom mobile app also makes it easier for your customers to reorder their favorites quickly—it’s a win-win since you can save on labor costs and make more profits with online orders. Metro Pizza uses Owner.com’s app and has had over 11,000 installs.

- Streamline pickup and delivery: You could implement a dedicated pickup area and use technology to streamline delivery processes, reducing the need for additional staff to handle these tasks. For example, Cava and Chipotle use a self-service shelving system where customers can simply pick up their delivery orders without needing assistance from staff.

- Schedule smarter: Use software to match shifts with busy times and cut down on idle hours. Some of my favorite apps for restaurant owners to help with scheduling are 7Shifts and ZoomShift.

- Cross-train staff: Train your team to handle different roles so you need fewer people on shift at once. For instance, you could teach your kitchen staff how to handle front-of-house tasks during busy hours.

Food and beverage costs

Percentage of total cost: 28%-30%

Let’s talk about the second biggest part of your restaurant’s financial puzzle—food and beverage costs. This includes everything from the ingredients and drinks you buy for your menu to the costs of food that gets wasted, packaging and any inventory mistakes. Keeping a close eye on these costs is key to staying profitable.

Food costs scale pretty linearly with demand, but profit margins for dishes can be all over the place. So you need a good handle on this as “more sales” might not translate to the profit you expect.

The average food cost percentage for the fast-casual and takeout industry typically ranges from 28% to 30%, but this can change depending on the type of restaurant you run. It’s usually higher for fine dining restaurants since their food cost is usually higher to accommodate premium ingredients. Higher-end restaurants typically serve wine and alcohol (these often increase the check size) are are more comfortable with higher food costs for that reason.

For more high-level insights on managing food costs, check out my video:

How to calculate food costs

Figuring out your food cost percentage is easier than you might think. Here’s a simple way to do it:

- Add up what you spend on food: Start by totaling everything you spend on ingredients and beverages for a certain period (like a week or a month). This is the cost of goods sold.

- Find your total sales: Next, calculate the total revenue from your food and drink sales during that same period.

- Calculate the food cost percentage: Divide the cost of goods sold by your total sales, and then multiply that figure by 100.

For example, if you spent $8,000 on food and made $28,571 in sales, your food cost percentage would be:

As mentioned above, this percentage will vary depending on the type of restaurant you’re running below. For example, a steakhouse can have a higher food cost percentage than a burger place and be just as—if not more—profitable.

See my recommendations on how to lower your food cost percentage below.

Tips to cut back on food costs

The thing is, lowering quality to lower costs rarely works. If anything, guests will put up with a lot as long as the food is amazing. So we have to improve our margins in other ways:

- Keep a close eye on inventory: Regularly check your stock to avoid buying too much and wasting ingredients. I recommend using the first-in, first-out (FIFO) method to make sure you use up older items first.

- Negotiate with suppliers: Never shy away from negotiating for better prices or discounts. Sometimes, ordering in bulk also helps me save money.

- Control portions: Stick to standard portion sizes to keep things consistent and avoid over-serving. Training your staff to measure portions accurately can make a big difference.

- Have enough profitable sides: As a general rule, restaurants should charge 3x times the food cost of the dish to help increase check size. But you probably can't 3x the price of your entrees. So we need to pair them with more profitable sides (e.g., chicken parm and garlic breadsticks) that we'll upsell online and in-person. Items like garlic sticks and fries are almost pure profit.

- Keep menus focused: Super large menus only work for the Cheesecake Factory. For small independent restaurants, they become deadly. You don't need to have dozens of menu items—which reduces spoilage and keeps food costs down overall.

- Reuse ingredients when possible: Try featuring dishes that use some of the same ingredients to save on food costs. For example, Chicken masala curry is usually made from leftover tandoori chicken, which is a great way to prevent waste.

- Use seasonal ingredients: When you use ingredients that are in season and locally sourced, they’re often cheaper and fresher—adjust your menu to take advantage of these!

Online delivery costs

Percentage of total cost: May vary

If you’re a restaurant that offers online ordering, you’ll also need to consider the costs of third-party apps and delivery fees. Third-party apps are great for promoting your restaurant but can charge from 15-30% on orders, like DoorDash charges.

For example, imagine someone orders a $50 meal. If the app charges a 20% fee, you're basically handing over $10 just to make that sale on their platform. That can really hurt your bottom line and add up over time.

How to save on delivery fees

Delivery fees can be spendy and eat into your profits, but they don’t have to. Here are some of my favorite ways to cut back on delivery fees:

- Encourage your customers to order through you: Promote direct ordering through your own website or app to avoid third-party fees. You can try giving discounts to first-time website visitors or dropping flyers into delivery bags that promote ordering directly. My friends at Aburaya Japanese Fried Chicken saved hundreds of thousands of dollars by switching to direct ordering from third-party apps.

- Set up a loyalty program: Get more customers to order directly through you with loyalty rewards or discounts when they do so. Saffron uses Owner.com’s loyalty program feature, and as a result, thousands of customers have enrolled and ordered directly from them.

- Incentivize pick-up orders: Give rewards or discounts to customers who choose pickup instead of delivery. For example, you could try a 'Pick Up and Save' deal, where customers get 15% off their order when they opt for pickup.

Rent and utilities

Percentage of total cost: 3%-10%

Let’s dive into two major expenses that can sneak up on you—rent and utilities. Whether you're paying for a prime downtown spot or a more laid-back suburban location, these costs will always be a big part of your budget. But here’s the good news—you can manage these without compromising the vibe and comfort of your restaurant.

Aim for your rent to fall between 6%-10% of your revenue, depending on the size, location and type of space you're in. Staying within this range helps balance overhead costs with other operational expenses like labor, food, and utilities. As for utilities, aim for around 3%-5% of sales. It’s all about striking a balance that works for your bottom line.

How to save on rent and utilities

- Negotiate your lease: To save on rent, negotiate favorable terms upfront, especially with independent landlords who are often more flexible. You can ask for lower rent in exchange for a longer lease or request a few months of free rent to help cover initial setup costs. Your lease is one of your restaurant's most critical contracts, so solid negotiations can significantly impact your business’s success.

- Look for shared spaces: If you don’t need a full-time location, consider sharing a space with another business. This can be a win-win, helping you reduce rent while still maintaining a physical presence. If you’re thinking of expanding with a second location, try a food truck instead of leasing another spot.

- Update to energy-efficient appliances: Want to shrink those utility bills? Consider upgrading to energy-efficient appliances. Yes, there’s usually an upfront cost, but trust me, the long-term savings are worth it. You’ll start noticing the difference in your utility bills, and it’s an investment that pays off quickly.

- Make extra cash with a sublease: If you have extra restaurant space that’s just collecting dust, consider subleasing it to another business to generate additional cash. Try hosting a pop-up shop or renting out the space for events during off-hours.

Restaurant marketing

Percentage of total cost: 3%-6%

Marketing is important for bringing customers through your door and keeping them coming back for more. But, it’s easy to overspend on marketing if you’re not keeping a close eye on it. A good rule of thumb I like to follow is to set aside 3%-6% of your revenue for marketing. This keeps your efforts effective without draining your resources.

If you already have a steady customer base, you can start with marketing to current customers for much cheaper. For instance, you can:

- Set up automatic emails

- Offer a mobile app

- Try win-back campaigns to get “inactive” regulars coming back

Costs here are limited to the discounts you use and sending emails/SMS, which is very cheap in comparison to paid ads or other "new customer" marketing channels.

Budgeting your marketing spend is key. Once you've set your budget, you’ll need to spread that investment wisely throughout the year. Take a look at your profit margins and consider which times of year your marketing dollars will make the biggest impact—whether it's seasonal promotions, local events or special holidays.

Want to get inspired with some fresh, out-of-the-box restaurant marketing tips? Check out my video below for practical tips on how to get the word out and boost your restaurant’s visibility:

Ways to make your marketing more profitable

Marketing can easily get expensive, but luckily, there are a lot of free and cost-friendly marketing tools you can use to capture the attention of new customers and engage current ones. Here’s how:

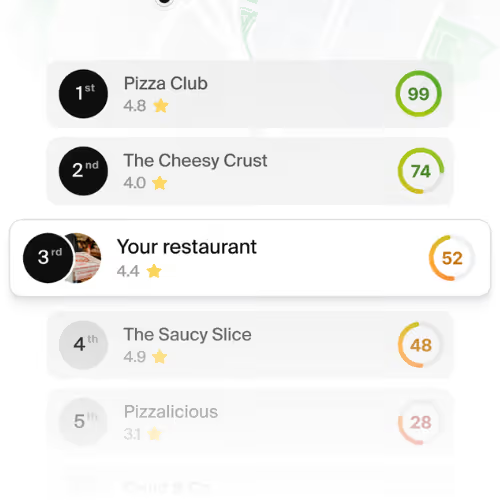

- Focus on local search: Help people find you by optimizing your site for local searches. Use location-based keywords and keep your Google Business Profile up to date. My friends at Talkin’ Tacos use Owner.com’s website builder for all of their target terms, and they rank at the top for all of them. It may take costs to get started, but local SEO pays you back much more than other channels. Plus, Google is the channel that customers prefer the most:

- Leverage SMS and email marketing: It’s so cheap and easy to use this service and it can have a lot of impact if done right. You can tailor your emails and texts based on what your current customers like. For example, send a special discount on their birthday or recommend dishes based on their past orders.

- Trade services with influencers: Partner with local food bloggers and influencers to spread the word about your restaurant. Try offering them a free meal or item to try your cuisine firsthand. In exchange, they’ll likely share honest reviews and recommendations with their followers, which can really help boost buzz around your restaurant and bring in new customers, which means more profit for you.

- Highlight special promotions: You can utilize limited-time deals, promotions and discounts to help boost profits. I also like to use loyalty programs to help streamline this. Make sure that the items you’re discounting or giving away for free are low-cost, high-margin items so you don’t dip into your profits.

- Use social media: Social media platforms are free to use to help you engage and connect with your customers. It’s not a surefire way to guarantee more profits, but you can do things like share what’s going on behind the scenes in the kitchen, highlight dishes, interact with customers and answer questions in the comments. Talkin’ Tacos does this well on their TikTok page and has received millions of views.

Other restaurant costs to plan for

I’ve already covered the biggest restaurant costs to keep in mind, but there are a few others you should consider setting some extra cash aside for. These expenses can creep up on you, so it’s wise to plan for them.

Some key restaurant costs I’d keep an eye out for:

- Repairs and maintenance: As a restaurant owner, unexpected repairs are just something you’ll have to expect. Whether it’s a broken oven or plumbing issues, these costs are something you have to prepare for, as they can add up quickly. I’d recommend having an emergency or buffer cash on the side in case something breaks.

- Staff training: Spending the money to properly train your employees is one of the smartest long-term investments you can make. It won’t only ensure your team is performing well, but it will also reduce turnover and potentially offset the cost of bringing on new staff—the average cost to hire a new employee is around $4,700!

- Appliances: This includes everything from your dining tables and chairs, silverware, utensils, and cooking tools like ovens. To lower costs, try buying used appliances or renting equipment. Also, ensure that everything is in top shape with regular maintenance checks so you can avoid costly repairs down the road.

- Restaurant technology: You should consider the cost of all the tools and software you need to run your operations, like your POS system, payroll software and payment processing tools.

Balance your restaurant costs for better profits

For all the little things that make up a restaurant, what makes it successful will ultimately show up in a simple formula: sales minus costs.

I see far too many restaurant owners forget that, at the end of the day, that formula needs to work for the business to work. Their big issue isn't investing too little in the business—it's not knowing their true costs until it's too late.

The good news is that you can get a handle on costs and even find ways to save money on things like inventory and employee wages.

If you're looking to cut costs and increase profits with more direct online orders, let's partner up. Try a free demo of Owner.com today.

Frequently asked questions

.jpg)

Co-founder, CEO of Owner

IN THIS ARTICLE

See how your restaurant's website stacks up against local competitors

.jpg)